With the number of inquiries we receive, we had to come up with a workflow that would allow us to handle the volume.

1. Fill out the appropriate inquiry form online.

2. Once the form is completed and has been submitted, we will review the inquiry to confirm if we can help you.

3. Within 48 hours from submission, a team member will contact you to schedule a call with our team to discuss your project.

We want to help as many entrepreneurs as we can and as quickly as we can. By managing our process this way, we are best able to achieve our goal of helping entrepreneurs raise the capital they require.

Please access our private equity application, real estate finance, and investor inquiry forms.

“Do not put all eggs in one basket.” ~ Unknown

In an interview with CNBC, Warren Buffet, the Oracle of Oklahoma, commented that diversification in every investor. Warren Buffett is the closest one could ever get to the holy grails in investing. When asked about investing, his advice is not to put all your investments in a single financial instrument.

As a nation, Americans prefer diversification in their long-term and short-term investments. A recent survey indicates that roughly 45% of Americans invest in stocks and bonds, 48.6% invest in properties, and 7.34% prefer cryptocurrencies. However, when it comes to saving for retirement, most of the Americans still rely on default stock and bond investments offered by their employers or retirement plan providers.

What if we tell you that there is a better way to invest for retirement?

Would you like to add private equity, real estate, or mortgage notes to your retirement portfolio?

Wait, is that even legal? How can I do that?

Well, the answer is simple, through a self-directed IRA.

What is a self-directed IRA?

- Open a self-directed IRA with the option to invest in alternative investments.

- Fund your self-directed IRA through regular contributions or qualified rollovers from existing retirement accounts.

- Use the funds in your SD IRA for investing in private equity or mortgage notes. The IRS requires your plan custodian to hold these investments.

- Your investments grow tax-deferred in your SD IRA.

- Distribute your investments at the qualified retirement age.

Make sure that any expenses related to the servicing or maintenance of your investments should come out of the retirement plan only. As a nation with a looming retirement crisis, it is critical to ensure that your investments grow at a decent rate. Alternative investments improve your chances of beating inflation while growing your assets in a tax-deferred manner.

“Ninety percent millionaires become so through owning real estate.” ~ Andrew Carnegie

Real estate is one of the oldest investment assets existing until now. Let it be American

businessmen, politicians, or actors; everyone favors real estate investments over other asset classes. Warren Buffett, one of the wealthiest Americans of all time, once said on CNBC, “I’d buy up a couple hundred thousand single-family homes if I could.”

There are several benefits of investing in real estate, including steady income, the ability to use leverage, property appreciation, and protection from market volatility. However, it comes with specific responsibilities. You should have sufficient time and skills for managing real estate. Most of the people do not have the additional time to look after real estate, limiting their investment choices to the traditional asset classes.

However, since you cannot buy real estate directly, why not invest in a mortgage note?

Mortgage notes offer the same benefits as physical real estate without the added work.

Americans have a net mortgage debt of over $15.76 trillion, so it’s safe to say that there will always be ample demand for mortgages.

Why mortgage notes are a smart investment choice:

- Your capital investment is secure: Mortgage notes are secured by their underlying real estate; meaning, in the case of a default, you can foreclose the property and recover your investment. The key here is to acquire secured mortgage notes only.

- You receive a steady stream of income: One of the primary reasons people prefer real estate over other assets classes is its ability to provide a consistent income stream. You’ll receive monthly installments, including the principal and interest amount. In case the property owner decides to sell or refinance the property, you receive an early payoff.

- You can easily manage a portfolio of notes: Unlike physical real estate, managing a portfolio of mortgage notes is quite simple. You can either service the notes yourself or engage a mortgage note servicing company for the same. You can hold multiple mortgage notes with ease.

- You can diversify your portfolio with mortgage notes: Diversification offers protection against market volatility. Adding mortgage notes to your investment portfolio provides diversification and protection against market movements. The typical interest on long-term mortgage notes can be between 7% and 9%, whereas short-term mortgage notes demand an interest rate between 12% and 15%.

How to add a mortgage note to your retirement portfolio:

- Open a self-directed IRA (SD IRA) that has a provision for alternative investments.

- Fund your SD IRA with qualified rollovers from your existing 401k or other defined-contribution plan and annual contributions.

- Choose a secure mortgage note for your portfolio and send the required paperwork to your custodian. It might take your custodian a couple of days to process the transaction.

- You can avail nonrecourse financing if you require additional cash for the purchase.

- The monthly installments for the note should be redirected to your SD IRA only.

- Any cost involved in the maintenance or servicing of the notes must come out of your retirement plan only.

Note: Avoid prohibited transactions within your SD IRA.

What would it be like if you bought the shares of Google or Amazon during their IPO? A

$10,000 investment in Google at the time of its IPO, with shares priced at $80, would have grown to over $160,000 today. In fact, if you had the chance to invest in any of the leading tech firms at their pre-IPO stage, your ROI would have been enormous. Unfortunately, the IRS back then, didn’t allow non-accredited investors to partake in venture financing investments, but that’s changing now. With the revised JOBS Act coming into effect in 2015, the IRS opened venture financial opportunities for regular investors, giving them a chance to invest in promising startups. Our team decided to put together a small guide for investors planning to start in venture financing.

- High returns on capital: Even small investments in fast-growing startups can offer

stupendous returns. The recent IPO of Uber is an excellent example of how early-stage investors booked profits on their investments.

- Ability to track unicorn companies at early stages: Since you’re likely to invest through a venture finance program run by veteran investors, investment bankers, and industry professionals, your chances of identifying unicorn startups are high.

- Preferred investment terms: Depending on your venture finance broker, investing in a company at an early stage comes with special privileges or preferred investment terms.

- Investors with a high-risk appetite: When investing in early-stage startups, you must take into account the risk of failure. If the company doesn’t succeed or provides meager results, you’re likely to take a loss or receive lower than expected returns.

- Investors with long investment horizons: Most of the startups take years, even decades, before going public, so you should participate in a crowdfunding event or venture financing program only if you have a long investment period. More importantly, invest funds that you’ll not need for years to come.

- Investors with no liquidity requirements/constraints: Venture financing comes with specific investment terms, and it is quite common to have lock-in periods for investors. As an investor, you should put money in an early-stage company only if you can hold your investments through the lock-in period.

Whether you’re picking up a box of doughnuts from Krispy Kreme or guarding your home with a security system like Vivint, you use services and products from private equity-backed companies every day.

Private equity is a major subset of a much larger, complex part of the financial landscape known as the private markets. Private equity is a form of financing where capital is invested into a startup or mature company generally in traditional industries, in exchange for equity.

Private equity firms invest in businesses with a goal of increasing value over time before eventually selling the company at a profit or hold the company in portfolio for the income stream. Similar to venture equity firms, PE firms use capital raised from partners to invest in promising private companies.

In contrast to VC firms that typically invest in later stage companies who have already achieved growth and profitability, PE firms and their partners often take a majority stake—meaning 50 percent ownership or more—when they invest in private companies. Private equity firms usually have majority ownership of multiple companies at once. A firm's array of companies is called its portfolio and the businesses themselves, portfolio companies.

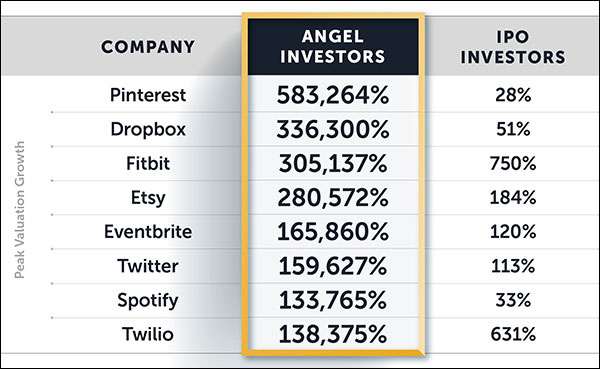

Chart by Angels and Entrepreneurs

Many of us have seen the opportunities in investing in a company’s IPO but have you seen the opportunities in angel investing? While these example companies are among the brightest stars on Wall Street in recent years, opportunities like this become available from time to time. Are you plugged in to get the info on the opportunities like these?

Click  here to request information.

here to request information.